Third-Party iPhone Insurance: Everything You Need to Know

What to Know

- You can get iPhone insurance via independent third-party companies, your cellular service provider, or even your renters/homeowners insurance.

- The cost, deductibles, and coverage of iPhone insurance varies greatly, so make sure to read all the fine print.

Congratulations on your new iPhone! It may be time to invest in some cell phone insurance! An insurance policy can protect you in case of damage, accidents, and sometimes even loss or theft. But is independent insurance, renters/homeowners insurance, or insurance via your cellular service provider the best way to go?

Disclaimer

Please keep in mind that although all insurance prices were accurate at the time of posting, they may change over time.

iPhone Insurance through Your Cell Coverage Provider

Most major cell phone service providers offer insurance plans, but do some checking to learn who provides the coverage and if it's worth the price before you sign up. Verizon, AT&T, Sprint, and Metro PC use an insurance company called Asurion. For more iPhone tips, check out our free Tip of the Day.

Cost of Asurion ATT Insurance

According to the website, iPhone insurance plans by AT&T for iPhones cost as little as $8.99 per month per mobile number enrolled. This covers one device and works for up to two claims per 12 consecutive months. Screen repair has a $49 deductible, and both repair and device replacement can happen as soon as the next day.

They also have plans for $15 per month per mobile number enrolled. This covers one device and works for up to three claims per 12 consecutive months. Screen repair has a $29 deductible, and both repair and device replacement can happen as soon as the next day.

This more comprehensive plan also includes device tune-ups, streaming support, unlimited photo & video storage, unlimited battery replacement, and even identity protection. This plan costs $40 per month if you have four devices. So is Verizon Mobile Protect worth it? It depends. Let's explore some other insurance options. If you are curious about T-Mobile insurance, you'll have to look into T-Mobile Protection <360> or Assurant T-Mobile insurance.

Loss or Theft Disclaimer

These plans cover both lost or stolen devices, accidental physical and liquid damage, and out-of-warranty malfunctions. It's always a good idea to read the fine print and check customer reviews.

When it comes to loss or theft, the price of replacing your device varies and has some alarming disclaimers. For an iPhone 15 Pro Max 256GB, the replacement deductible is $250. The fine print explains that the replacement device will be either the same or similar-quality iPhone model. It may also be refurbished. The deductible replacement cost depends on the model and can be looked up on AT&T's website.

All this information was taken from AT&T's website; however, since Asurion is also used by Verizon, Sprint, and Metro PC, we can assume that their insurance is the same or similar in both cost and coverage.

Third-Party Insurance & Renters or Homeowners Insurance

Another option if you don't want insurance through your cell coverage provider is to either get independent third-party insurance or add your iPhone to your renters/homeowners insurance.

Third-Party Insurance

Besides AppleCare+ and provider-based insurance, another option is third-party insurance from a company like SquareTrade or Geek Squad. Some of these cover not just iPhones but bundle other electronics for more comprehensive electronics insurance.

Insurance through SquareTrade

SquareTrade is affiliated with Allstate. You can currently purchase one year of coverage for $8.99 per month for one device or $19.99 per month for a family plan of four devices. Deductibles cost $149 deductible, and this applies to all SquareTrade smartphone claims. This is regardless of device type, model, age, or the accidental damage caused. You can make up to four claims per year.

SquareTrade covers accidental damage from drops and spills and hardware like battery and charging port damage. Trips to the Genius Bar are covered, so you won't void your original iPhone warranty by using an unauthorized service.

Coverage can carry over to new devices and cell providers as well. Still, SquareTrade doesn't cover loss or theft, so not every possibility is accounted for in this insurance plan. Similar to Asurion, SquareTrade reserves the right to replace your damaged device with a refurbished one. Take a look at how customers reviewed SquareTrade in Consumer Affairs.

Insurance through Geek Squad

Geek Squad, sometimes called Best Buy insurance, is similar third-party insurance coverage offered by Best Buy within 15 days of purchasing your iPhone. Complete Protection covers accidental damage, battery replacement, mechanical failure, accessories, and even loss and theft. Service fees are $149 or $199, and replacement deductibles are $199 or $249, depending on the iPhone. See their reviews on Consumer Affairs.

Use Your Renters or Homeowners Insurance to Include Your iPhone

If you have a renters or homeowners insurance policy, it may be possible to add coverage for your electronics in case of damage or theft. Not every insurance company provides this service, though. For those that do, such as Allstate and Progressive, you can include your iPhone in your insurance policy for less than it would cost to pay Apple or a third-party company, and with lower deductibles, too.

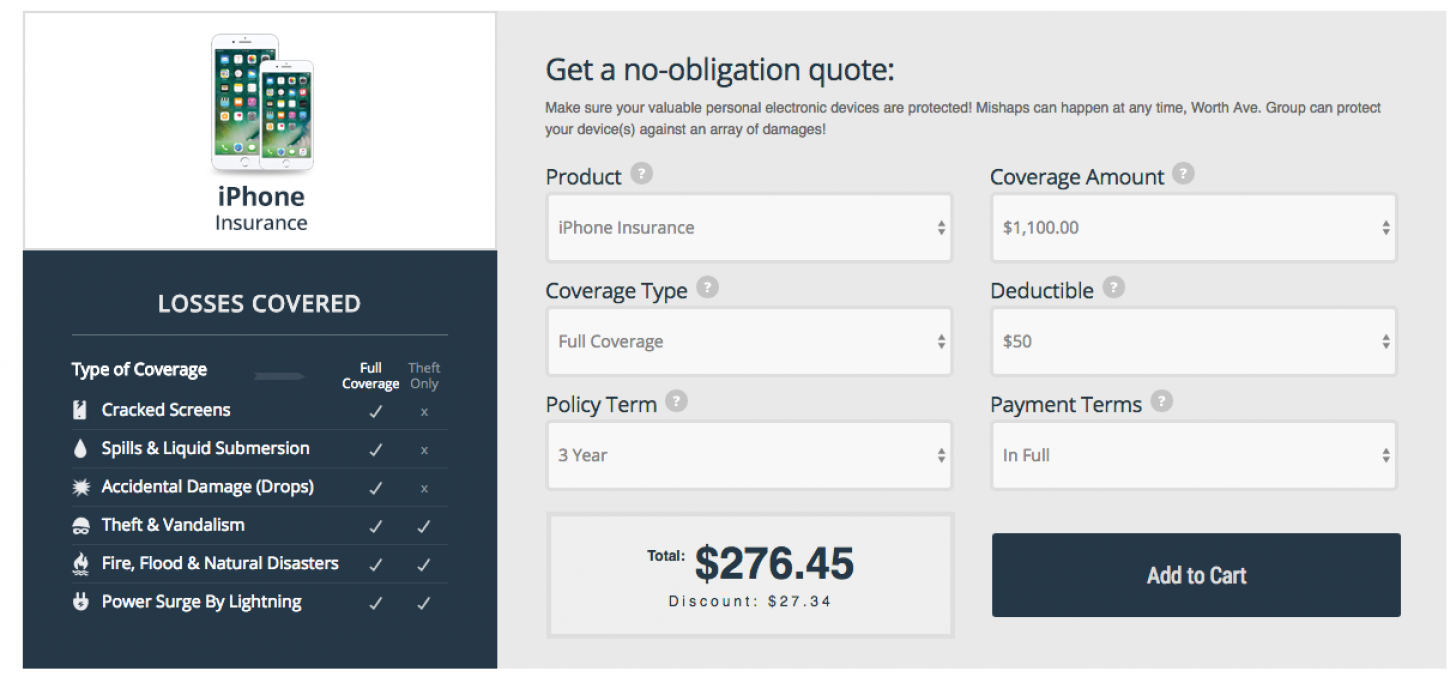

My quote for one-year comprehensive coverage on my iPhone Pro Max is $10.50 per month for the coverage amount of $1,100 with a $75 deductible. The three-year plan would make it cheaper at $8 per month, although it would require you to pay $291.90 in full.

Risks to Consider

A word of warning, though: homeowners insurance companies may increase your premium, drop your coverage, or refuse to renew your insurance if they feel you've made too many claims. This is because you're considered a higher risk. It's doubtful that your coverage would be canceled over just one claim, but it is a factor to consider in your decision.

Lots of people, including me, bundle their car insurance with their homeowners or renters insurance. Thinking about my premium going up or losing my coverage altogether makes me think twice about the idea of including my cell phone in this important coverage.

Other Options besides iPhone Insurance

Besides purchasing a separate iPhone policy or extending homeowners insurance to cover your device, is there another way to insure your cell phone? I haven't found any other insurance alternatives at this time, but I do have three steps to take, plus a bonus tip for parents that can protect your iPhone and keep your budget from busting in the case of an emergency.

Purchase with a Credit Card

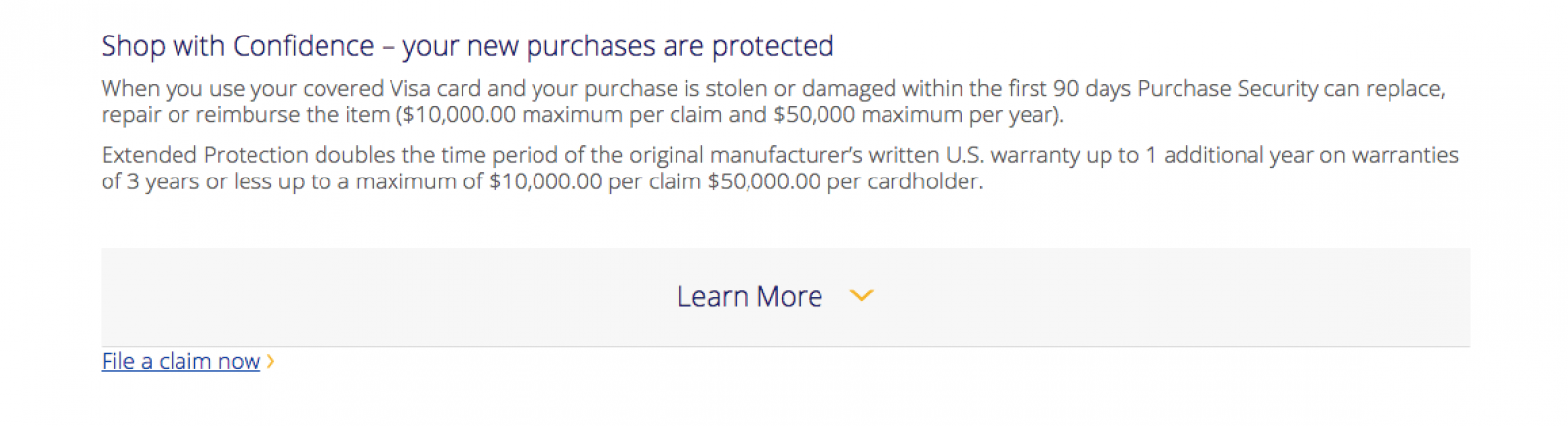

Here's an option to look into if you'd like an extended warranty on your iPhone without having to pay anything at all for it. Did you know that some credit card companies offer something called Purchase Security or Purchase Protection if you pay for your device with your credit card?

Visa, for example, doubles Apple's one-year warranty and will replace, repair, or reimburse you if your iPhone is lost, damaged, or stolen within 90 days of purchase. This will take up to five business days from the time your claim is approved, but at least you're not paying for this coverage.

Purchase a Sturdy Case

I know this should go without saying, but buy a protective case that will save your iPhone from the inevitable bumps and drops that happen in day-to-day life. There are several pros and cons to consider before you get a case or screen protector for your iPhone.

Save Your Last iPhone

It can be tempting to trade in your iPhone when you're ready to upgrade and get at least a bit of money off the purchase of your new device. If your phone is in good shape, though, why not keep it in case you need a backup?

Having an iPhone on hand that you're familiar with and can easily transfer back to is a major convenience. Plus, when it's time to upgrade again, you can always trade-in your backup iPhone and then keep the more recent device as your new backup.

Save a Bit

If you're reluctant to pay money for an insurance policy that you may never use or have a large deductible, why not set the money aside that you might have otherwise spent on that policy? For example, with my Progressive quote, I could set aside nearly $300 and then add ten or twenty dollars a month until I have a nice cushion if I need to repair or replace my iPhone.

Get Your Kids Invested in Their iPhones

If you have a child you're planning to purchase an iPhone for, consider having them work for at least a portion of the cost. This could be through chores, a part-time job, or saving birthday and holiday money.

This way, their device's value will be much more concrete for them, and they'll be careful not to treat it carelessly or leave it where it can be stolen. Let them know that if the iPhone is broken or goes missing, you'll be happy to provide a flip phone until they can save up enough money to replace it

So, we’ve gone over many different types of insurance with varying coverage and cost. Personally, I decided to get AppleCare Plus insurance the day I decided to buy my iPhone 15 Pro Max. Especially since I've had a phone stolen before, the idea of paying up to $149 to replace a $1,200+ phone sounds fantastic. Based on the price and coverage comparison, I believe that the best iPhone insurance is AppleCare Plus. First, AppleCare costs are great in terms of monthly payments and deductibles. But also, in case of loss, AppleCare coverage will provide you with a new replacement phone of the same model. The downside is that you have to buy AppleCare Plus within 60 days of buying your new iPhone. If you miss this time frame, you may want to consider other options. Luckily, there are plenty of options for iPhone protection that are perfect for your budget.

FAQ

- How much is AppleCare+? It depends on your iPhone model and if you want Theft and Loss coverage in addition to AppleCare Plus, but the cost is between $3.99 and $13.99 per month.

- What iPhones Are Waterproof? No iPhone is waterproof, but many iPhone models are water-resistant to a certain extent. While even the most water-resistant iPhone can survive being dunked in water, you should try to keep your phone away from water whenever possible.

Top image credit: Riccio da favola / Shutterstock.com

Leanne Hays

Leanne Hays has over a dozen years of experience writing for online publications. As a Feature Writer for iPhone Life, she has authored hundreds of how-to, Apple news, and gear review articles, as well as a comprehensive Photos App guide. Leanne holds degrees in education and science and loves troubleshooting and repair. This combination makes her a perfect fit as manager of our Ask an Expert service, which helps iPhone Life Insiders with Apple hardware and software issues.

In off-work hours, Leanne is a mother of two, homesteader, audiobook fanatic, musician, and learning enthusiast.

Olena Kagui

Olena Kagui

Rhett Intriago

Rhett Intriago

Amy Spitzfaden Both

Amy Spitzfaden Both

Rachel Needell

Rachel Needell

Leanne Hays

Leanne Hays